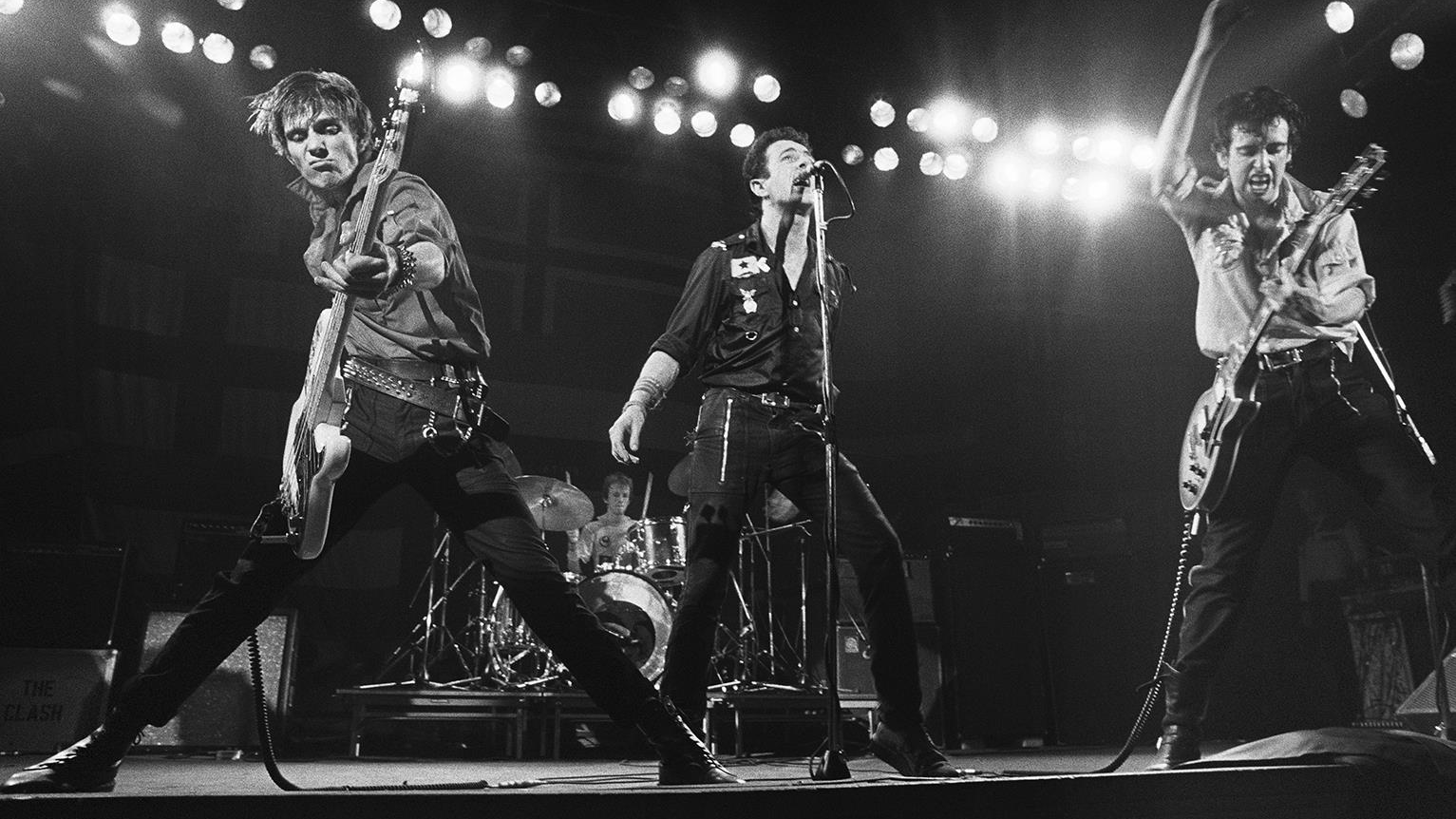

Lyrics from the Clash’s hit, “…you got to let me know, should I stay or should I go?” rings so true for investors and their money during these unprecedented times, either in pursuit of better returns or to hedge against South African specific risk.

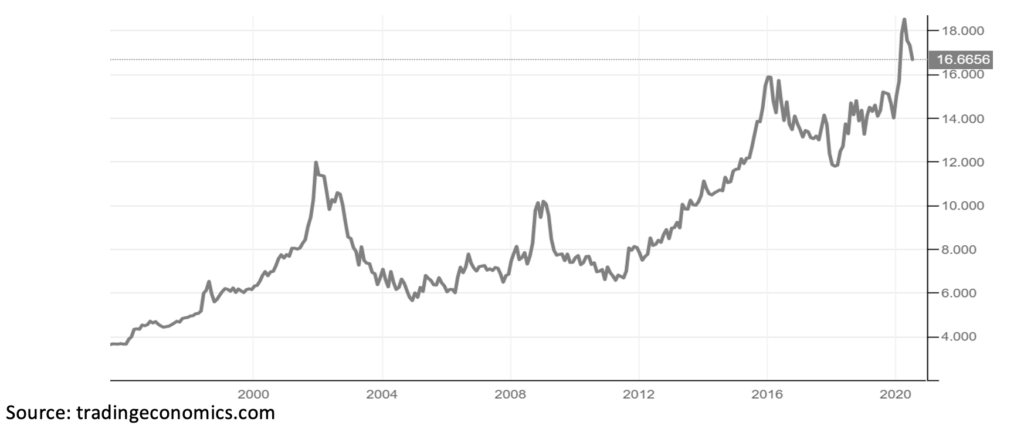

A handful of fortunate South Africans, mostly people with retirement savings, have the stressful luxury of contemplating whether they should cash in their retirement funds and take the money offshore. This is a complex decision, and various factors play a role, but most importantly, is a view on the direction of the rand exchange rate. The rand is one of the most volatile currencies in the world. One should therefore not be surprised that historically and depending on the period under consideration, the weakening of the rand contributed up to 50% of the ultimate return earned offshore over longer-term periods. The chart below illustrates the structurally weakening trend of the rand against the dollar over the past 25 years. This trend is unlikely to break considering South Africa’s fiscal, economic and political challenges. What the chart also highlights, is how unfortunate it would have been, at least for several subsequent years, if money were taken offshore at exactly the wrong time. Examples of such instances include 2002, 2009, 2016 and more recently in 2020 when the rand tested a level of R20 against the dollar. Be cautious of reacting emotionally when making investment decisions.

To provide perspective and help guide investors in deciding whether they should take their retirement fund money offshore, consider the following example.

Base case scenario

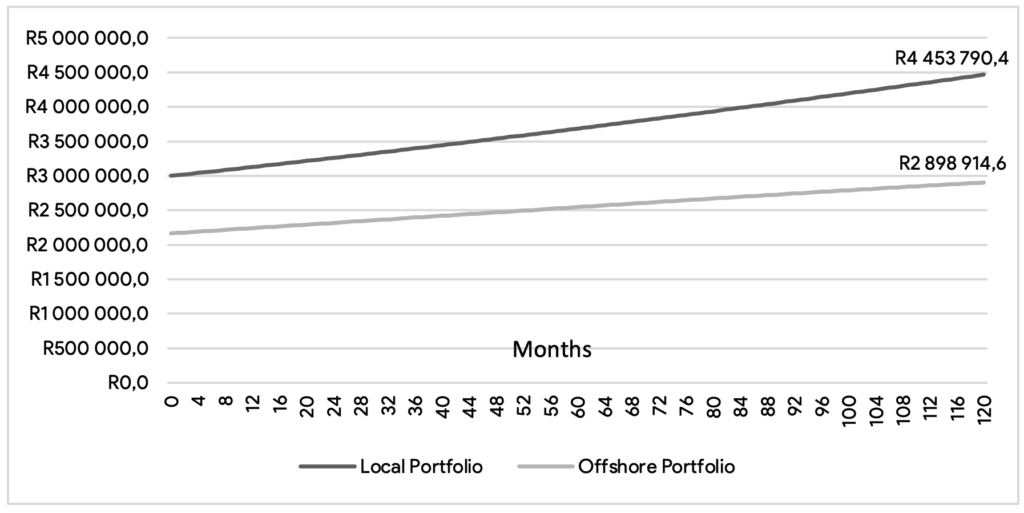

Take a person with R3 000 000 invested in a South African registered retirement fund. The decision is simple; keep it, or cash it in, pay tax and invest the proceeds offshore. A lump sum retirement benefit withdrawal of R3 000 000 upon retirement would attract tax of about 28%, which means that only about R2 160 000 would be available for investment offshore after paying tax. The implications are that a significantly higher return would need to be earned offshore to make up for this tax loss.

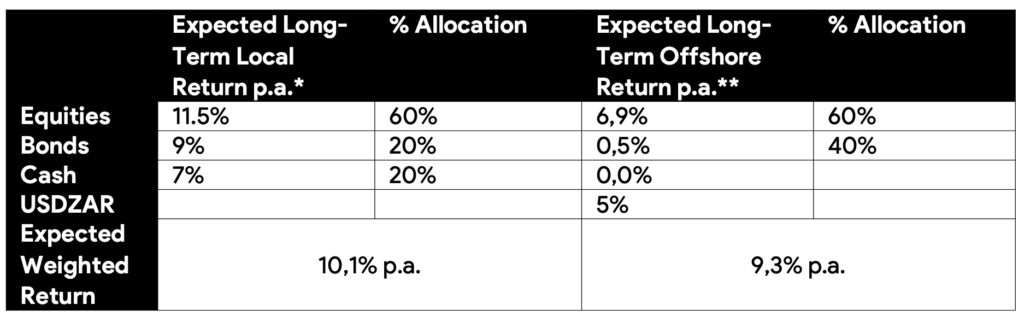

We assume that the investor has a time horizon of 10 years, an initial income requirement of 6% growing at inflation per year and a choice between two investment strategies, a local balanced option consisting of 60% SA equity, 20% SA government bonds and 20% SA cash, and an offshore balanced option consisting of 60% US equity and 40% US government bonds as proxies. We assume that South African inflation will average 5% per year, and for simplicity, we ignore the effect of fees (which could be similar in both cases). 5 to 10-year asset class return assumptions are informed by valuations while the rand is assumed to depreciate at interest rate differentials or uncovered interest rate parity theory, which is at 5% p.a. Based on these assumptions, a local balanced portfolio is expected to return 10,1% per annum over the next 10 years while the offshore balanced portfolio is expected to return 9,3% per annum in rands.

In this base case scenario, the investor who cashed in his/her retirement fund and reinvested the after-tax proceeds offshore is never better off and ends up with a pre-tax terminal investment value after 10 years that is 35% lower (R2 898 914,60 versus R4 453 790,40) than the contrary option of staying invested locally.

Alternative scenario

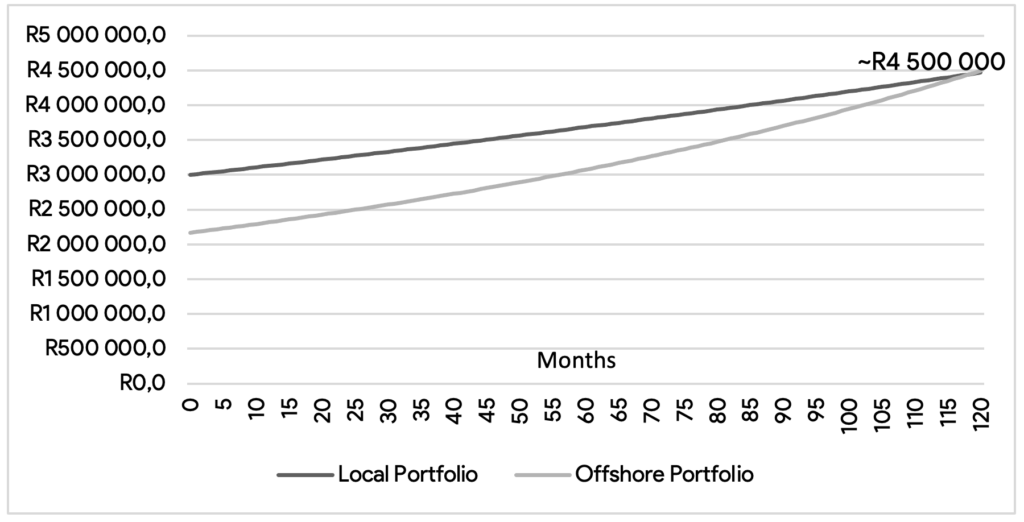

For the investor who cashed in his/her retirement fund and reinvested the after-tax proceeds offshore to end up in the same pre-tax position after 10 years as illustrated in the below chart, the rand will need to depreciate by ~8,25% per year assuming all else remains equal. To put this into context, the rand will need to be at R36,85 against the dollar by 2030.

The merits of cashing in one’s retirement fund and pursuing a better outcome with the after-tax proceeds remain highly questionable at best. This is due to it not being possible to consistently predict future asset class returns or exchange rate levels with accuracy or conviction. Subject to an investor’s risk profile and objective, it does however remain wise and in fact recommended, to invest discretionary money in a well-diversified global portfolio from the get-go.

0 Comments