Do you have tax fatigue? There is relief for savers. A tax-free savings account (TFSA) is exempt from tax on capital gains, interest and dividends. TFSAs were introduced in 2015 to incentivise and encourage household savings. TFSAs are ideal for long-term investors or those who have already exhausted other available tax-efficient savings options.

We feel strangled by tax. Some South Africans can pay up to as much as 60 – 70%effective tax rates on every cent earned. Wow. Well, add up income tax, value-added tax, sin taxes, fuel levies, municipal rates and taxes, capital gains tax, tax on interest, dividend withholdings tax, transfer duties, you name it, and the tax burden becomes crippling. We want to break free from tax, that is legal of course, so when the tax-man grants you a tax-free lunch, take it.

What is a TFSA?

Most banks, long-term insurers, unit trust management companies and linked investment services providers now offer TFSAs. Any investment returns, be it capital gains, interest or dividends, are tax-free. TFSA contributions, which are not tax-deductible, are currently limited to R36 000 per annum and a lifetime contribution limit of R500 000 per individual. Contributions over these limits are penalized at 40%. The tax-man encourages long-term investing and keeps track of contributions, therefore, the re-contribution of any withdrawn amount is classified as an additional contribution.

When should I invest in a TFSA?

Like yesterday. If you can, invest R36 000 at the start of the tax year on the 1st of March every year until you reach your lifetime contribution limit of R500 000. This approach will maximise your ability to generate tax-free returns over the full course of every tax year. Just like you cannot win the lotto without buying a ticket, you cannot earn tax-free returns if you are not invested, right? So, the earlier you invest the maximum allowable contribution in a TFSA, the better.

Other things to consider

Generally, the tax payable on returns earned on taxable unit trust investments depends on each investor’s marginal tax rate and the type and amount of capital gain and income earned in the unit trust. Because TFSAs attract no tax, they offer a great tax liability reduction mechanism in addition to annual interest and capital gains tax exemptions of R23 800 and R40 000 respectively, if under the age of 65, and of course tax-deductible retirement fund contributions (capped at 27.5% of taxable income). Subject to TFSA contribution limits, a TFSA is flexible in terms of the frequency and quantum of contributions and withdrawals and is transferrable between providers. Upon death, your TFSA benefit is also immediately payable to your nominated beneficiary.

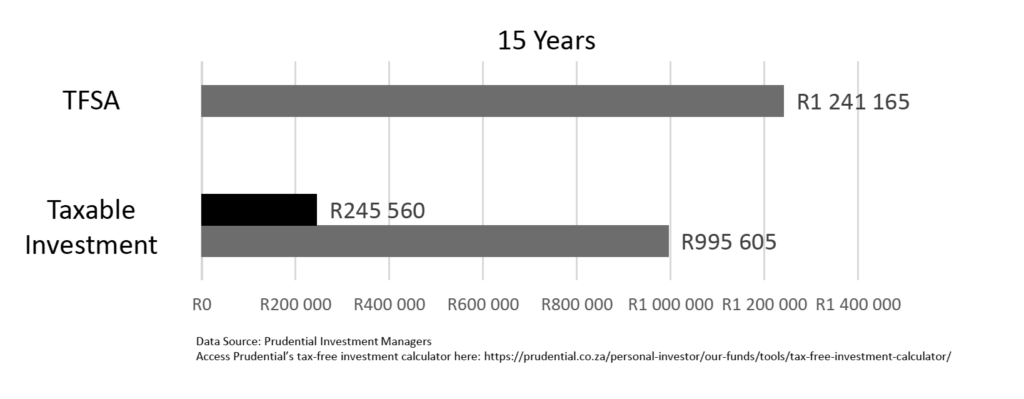

Show me the tax benefit

Based on variable inputs and certain assumptions, Prudential Investment Managers provides an excellent online tool that clearly demonstrates the tax benefit associated with a unit trust investment made via a TFSA against the alternative of investing into the same unit trust, but not through a TFSA. If an investor invests R3 000 per month over 15 years into the Prudential Balanced Fund via a TFSA, the TFSA investment is projected to grow to R1 241 165 which includes a tax saving of R245 560. This tax amount would have been payable had the investment not been made via a TFSA, assuming that the investor is subject to an effective capital gains tax rate of 18% and have already exhausted available tax exemptions. The tax saving in the TFSA effectively increases the after-tax return of 9.4% in a taxable investment to a tax-free return of 10.8% per annum. A no-brainer indeed.

Consult your financial adviser

Before opening a TFSA, consult your financial adviser to ensure that you elect an appropriate and cost effective TFSA for yourself, your partner, your children and encourage your friends and family to do the same

0 Comments